Top Gold Ira Investment Companies 2022

Gold Etf

Opening an account online is easy, and shouldn't take more than a couple of minutes, or you can deal with one of their agents to make it even simpler. As soon as you have actually established your account, you can fund it with a transfer, a rollover of an existing retirement account such as a 401(k), another IRA, a TSP (thrift savings plan), 403(b), or 457 account, or through new contributions.

Gold, silver, platinum, palladium Gold, silver, platinum, and palladium IRARoll over existing retirement accounts, Exceptional consumer service Yearly Account Charge: $75 for accounts under $100,000; $125 for accounts over, Yearly Storage Cost: $100 annually Easy to open account, Lots of account alternatives, Less instructional products Pros and Cons of a Gold Individual Retirement Account Unsure whether gold Individual retirement accounts are right for you? Get the quick takeaway with these pros and cons.

Precious Metals - Gold Ira - Silver Ira

Many of the companies we've talked about here have made a point of simplifying the procedure so that it's as easy as possible. Here's what you can expect: As soon as you have actually picked which gold IRA custodian you wish to use, visit their website and sign up. They'll request for a series of personal recognizing details and usually direct you through the process of setting up an account.

Once that's done, you're prepared to buy some gold. Many gold IRA suppliers also operate as precious metals dealerships and can use you better prices on IRS-approved fine-quality gold than you may find somewhere else. If they don't offer gold themselves, opportunities are they'll have the ability to point you in the instructions of dealers they rely on.

7 Best Gold Ira Companies Of 2022 Ranked And Reviewed

Does Charles Schwab provide a gold IRA?Charles Schwab doesn't offer a gold IRA, however it does provide the Invesco Gold and Unique Minerals Fund, which can offer financiers with direct exposure to the rare-earth elements market by buying stocks of business that handle mining, processing, and trading them. If you wish to open a gold individual retirement account, consider among the business above (gold etf).

How much gold is a good investment?

10%. One rule of thumb is to keep gold to no more than 10% of your overall account value. Gold has previously moved in the opposite direction of the U.S. dollar, so some investors use it as a hedge against inflation.

Will gold price go down in 2022?

Joni Teves of the investment bank explains why the strength of gold is "ultimately short-lived" and discusses the factors that are part of its "negative backdrop."

Which country has cheapest gold?

Hong Kong. Hong Kong is currently the cheapest place to buy gold. The premium on Australian Nuggets, a type of gold coin, in Hong Kong is some of the cheapest gold to buy in the world at around $1,936 for a one-ounce gold coin.

How do I invest in gold stocks?

Return rates of physical gold are never profitable if you invest in the gold jewellery. The reason being that the price of jewellery is not only determined by the gold rates but it also includes the making charges and this is the just the half story i.e. when you purchase the gold.

While the worth of the dollar has actually reduced in time, gold has actually shown more resilient. By buying your gold through an individual retirement account instead of purchasing gold straight, you can prevent some of the taxes related to it. That stated, it's likewise essential to remember the downsides of investing in a gold individual retirement account.

Top Gold Investment Companies: Gold Ira Company Reviews

If you are insistent on purchasing physical gold, keep in mind that generally diversity is considered a crucial tool for mitigating danger, so consider keeping gold as just a portion of your portfolio. And if you desire to invest in precious metals with more flexibility and liquidity, you may consider a gold ETF rather, which offers you direct exposure to gold as a property, but can be bought through a routine retirement account.

Nevertheless, the Vanguard Global Capital Cycles Fund (VGPMX) consists of rare-earth elements and mining companies, which comprise about a quarter of this portfolio. If you wish to purchase gold straight, you'll require to look in other places. Typical Gold IRA Fees to Keep An Eye Out For There are numerous costs frequently associated with a gold IRA.

Should You Invest In A Gold Ira?

Account Setup Charge: This is a one-time charge charged by some IRA companies when you open your account, and normally ranges in between $50 and $150. Yearly Custodial/Administrative Charge: Charged by your Individual retirement account for managing your account.

Gold Markup: The quantity that the Individual retirement account charges in addition to the area or market rate of your gold. Ideally, you'll pick a business that reveals it. etfs physical gold.

Best Gold Ira: Top 5 Gold Ira Companies In 2022

In a world increasingly reliant on technology, it can be assuring to understand that at least some of your retirement investments are based on something you can see and touch. With these retirement accounts, your gold is safely custodied in a vault, and not putting lumps under your mattress. With any of the companies on this list, it's easy to open a new account or rollover an existing IRA or another retirement account.

Note: This site is enabled through monetary relationships with some of the services and products mentioned on this website. We might get payment if you go shopping through links in our material. You do not have to utilize our links, however you help support Credit, Donkey if you do.

Best Precious Metal To Invest In

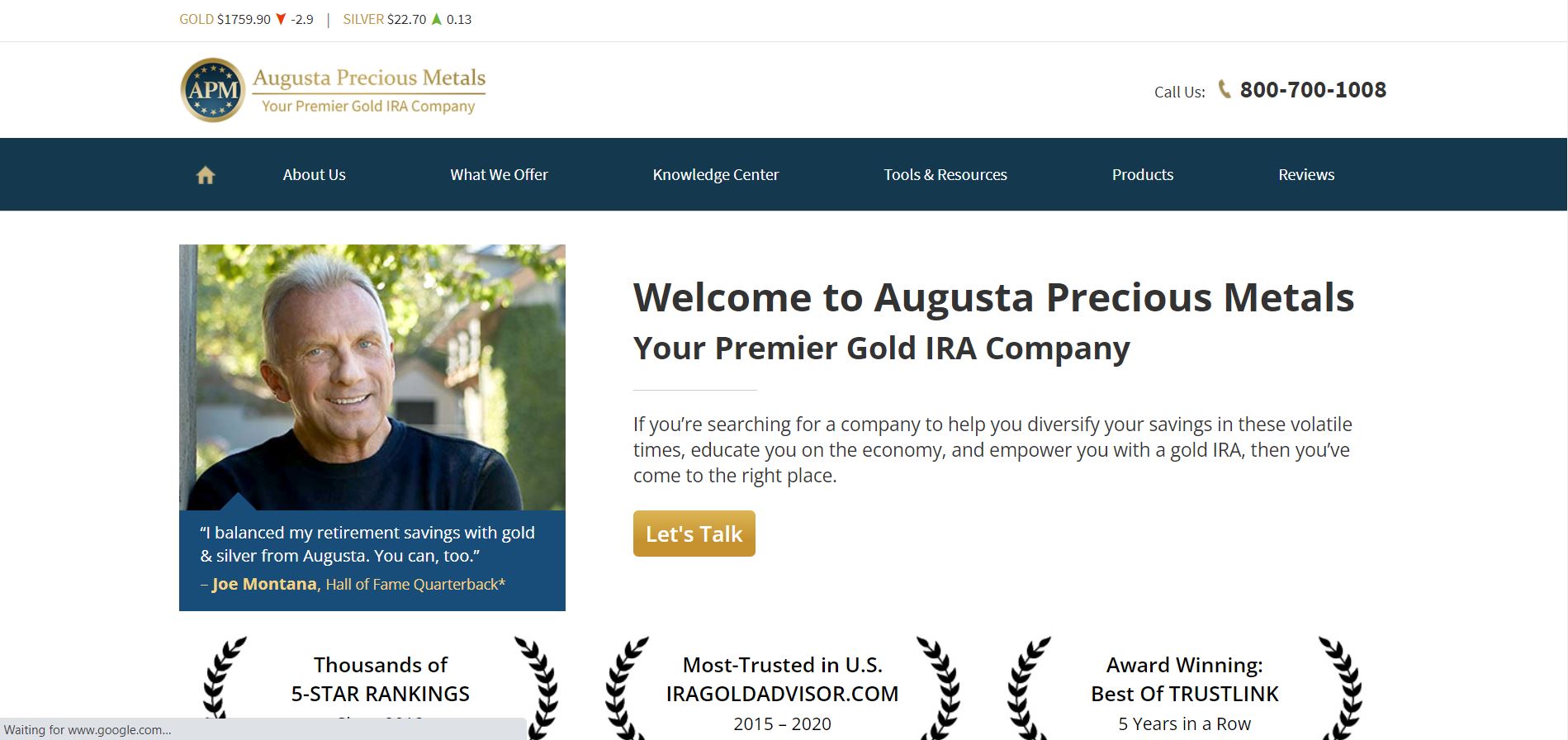

Obligation Gold's mission is to assist people protect their wealth and pension by diversifying and buying physical precious metals. With over 50 years of combined experience, millions of dollars in completed deals, leading to countless pleased clients, assisted us earn the most Trusted Gold individual retirement account company in the nation.

At Allegiance Gold, we have achieved the greatest possible ranking validated by third-party consumer defense agencies. Being members of leading industry watchdog groups such as the American Numismatic Association (ANA), Market Council for Concrete Possessions (ICTA) and the U.S. Chamber of Commerce provides us with the most current insights about precious metals.

6 Top Gold Investment Companies & Best Rated Iras

As an outcome, we have put every customer on the path towards retirement preparedness. Regardless if you are a novice financier or a knowledgeable one, Allegiance Gold's method is developed to help you meet your brief and long-lasting monetary strategies. No matter what your goals might be, our objective stays the very same to assist you diversify and retire more conveniently.

(This review page was upgraded in March 2022)Choosing the right gold individual retirement account business is simply as essential as selecting the best elements to consist of in this retirement automobile. An appropriate gold IRA business will supply totally free printed product concerning a gold individual retirement account rollover that can be examined and absorbed. They will also offer a representative who can address all concerns you might have after having examined the requested materials. etfs physical gold.

Gold Ira Companies Review 2022 - Top Rated Companies

A suitable Gold IRA company need to be a one-stop store, capable of making all of the necessary plans, in order to help with a quick, tax-free, and problem-free account opening. Gold IRA Rollover from 401K 403B, 457BA Gold individual retirement account can be produced from scratch, by utilizing funds, up to the yearly maximum contribution of $5,500 for financiers under 50 years of age, or $6,500 for investors over the age of 50.

In addition, a proper Gold IRA business will have the ability to start transfers or rollovers with more uncommon individual retirement account's, like Spousal and Beneficiary individual retirement account's. Benefits of a Gold IRA Account, The factor for creating a Gold IRA account is three-fold. Of all, gold and other valuable metals have a history of long-lasting appreciation.

Gold Ira Company Reviews

Gold and other physical precious metals are the ultimate hedge versus potential losses by other popular investments like stocks, bonds, and currencies, because historically speaking, when most other investment lorries collapse or go to pieces, precious metals appreciate and excel. Another tremendous benefit of a Gold backed individual retirement account is the ability to transform principal and benefit from investments on a tax-free basis. top gold investment companies.

this explanation visit site Clicking Here click site